There are a lot of talks these days about financial wellness. But what does that really mean? And why is it so important? In this blog post, we will explore those questions and more. We will discuss the definition of financial wellness, and look at some of the key benefits it can provide. We will also take a closer look at some of the factors that contribute to financial wellness, and offer some tips for improving your financial wellbeing.

Finances are a major stress factor for many Americans. In fact, money is the leading cause of stress in the United States, according to a recent survey by the American Psychological Association. This is not surprising when you consider all of the financial responsibilities that we have. We have to pay our bills, save for retirement, and manage our debt. And if we're not careful, it can all become too much to handle.

That's why financial wellness is so important and why you should get an education in it. Getting a financial education about financial wellness is about more than just getting by from month to month. It's about taking control of your finances and making sure that you're on track to meet your long-term financial goals.

There are many benefits to financial wellness. For one, it can help reduce stress. When you understand your finances and are in control of your money, you'll feel less anxious about your bills and your future.

It's not uncommon for people to wait until they're in their 30s or 40s to start thinking about their finances. By then, they may have already accumulated a significant amount of debt and be struggling to make ends meet each month. Waiting too long to take control of your finances can have serious consequences down the road.

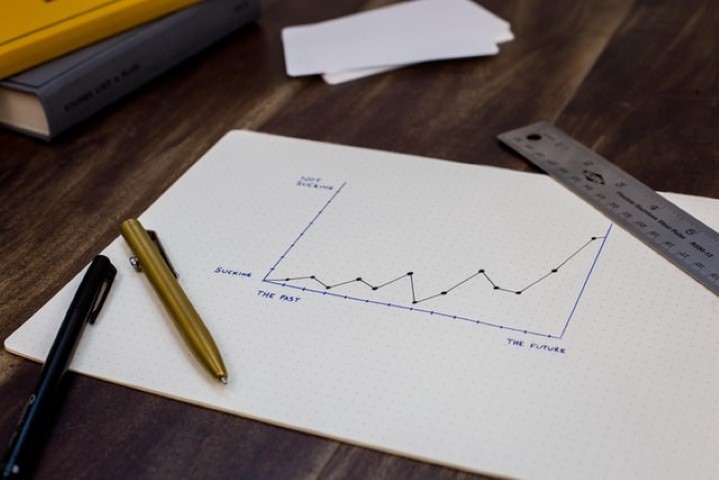

That's why it's so important to start managing your finances as early as possible. The sooner you start, the more time you'll have to get your finances in order. And believe me, managing your finances takes time. You can't just sit down and balance your checkbook once a month and expect everything to be fine.

You need to be constantly monitoring your spending, saving, and investing. This may seem like a lot of work, but it's worth it in the long run. Trust me, I know from experience. I didn't start taking my finances seriously until I was in my 30s and by then it was too late. I had already accumulated a ton of debt and was just barely scraping by each month.

If I had started sooner, I would be in a much better financial situation today. So if you're not already taking control of your finances, I urge you to do so as soon as possible.

A spending plan is an important tool for financial wellness. It can help you track your income and expenses, so you can make informed choices about how to spend your money. Creating a spending plan can be as simple as creating a budget or tracking your spending for a month.

There are many benefits to creating a spending plan. It can help you stay on track with your financial goals, make informed choices about your spending, and help you reduce your overall debt. If you are struggling to make ends meet, a spending plan can also help you identify areas where you can cut back on your spending.

If you are interested in creating a spending plan, there are many resources available to help you get started. You can find budgeting worksheets and templates online, or you can speak to a financial advisor about creating a spending plan that meets your specific needs.

Debt can be a major financial stressor. If you're struggling to keep up with your payments, it's important to understand your options and develop a plan to get out of debt.

There are a number of resources available to help you manage your debts, and many ways to improve your financial wellness. With a little planning and effort, you can get your finances back on track and reduce your stress.

There are a few things to keep in mind when you're trying to manage your debts. First, make sure you understand all of the terms and conditions of your loans. This includes the interest rate, repayment schedule, and any fees or penalties.

It's also important to know your rights and responsibilities as a borrower. Be sure to stay current on your payments, and don't hesitate to contact your lender if you have any questions or concerns.

If you're having trouble making your payments, there are a number of options available to help you get back on track. You may be able to negotiate a lower interest rate or extended repayment period.

You can also look into consolidating your debts, which can help you reduce your monthly payments and make it easier to keep up with your obligations. There are a number of resources available to help you understand your options and make the best decision for your situation.

No one ever wants to think about what they would do if they lost their job, but it's important to have an emergency plan in place nonetheless. If you're not sure where to start, sit down and map out your expenses for a month.

This will give you a better idea of how much money you need to live and what expenses you can cut back on if necessary. From there, you can start setting aside money each month into savings so that you have a cushion to fall back on in case of tough times.

It's also important to have an emergency fund in place for unexpected expenses that may pop up, like car repairs or medical bills. A good rule of thumb is to have at least three to six months' worth of living expenses saved so that you're covered no matter what life throws your way.

In conclusion, taking control of your finances is an important step to ensuring your overall well-being. There are a number of resources available to help you get started, and the sooner you start taking action, the better off you'll be in the long run.